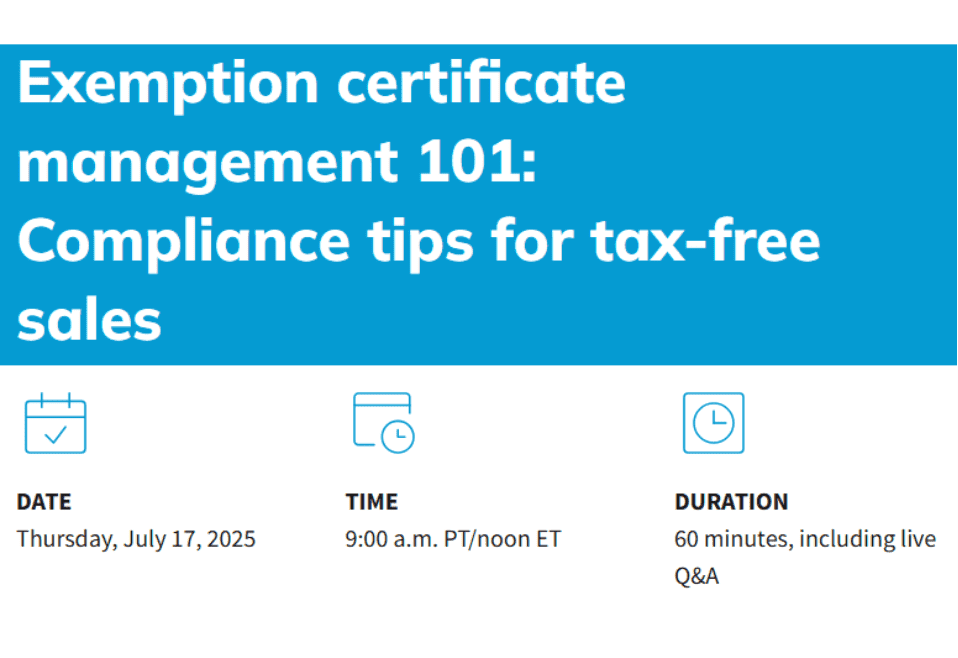

Exemption certificate management 101: Compliance tips for tax-free sales

Exempt sales aren’t exempt from risk — what you need to know If your business makes tax-exempt sales, managing exemption certificates is key. Learn the basics and find out how to streamline collection and tracking to improve customer experience and reduce audit risk. If your business has tax-free sales, don’t...