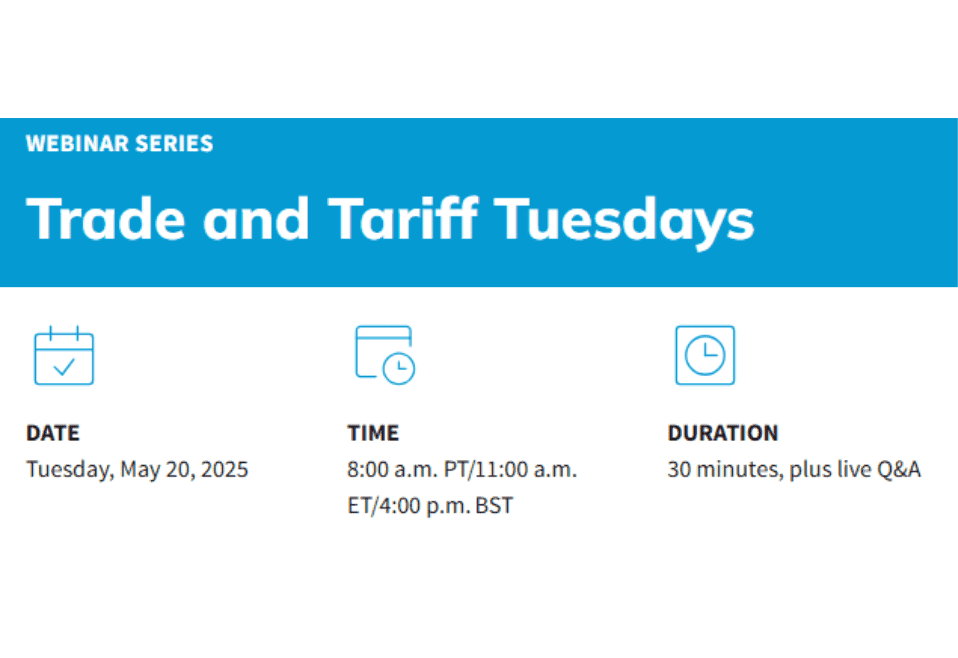

Trade and Tariff Tuesdays

Join Avalara experts weekly for insights on trade tax and tariff compliance Avalara experts will discuss the latest developments in trade and tariff activities, including proposed tariffs by the United States and other nations, the future of the de minimis exemption, and how these changes could affect trade compliance and...