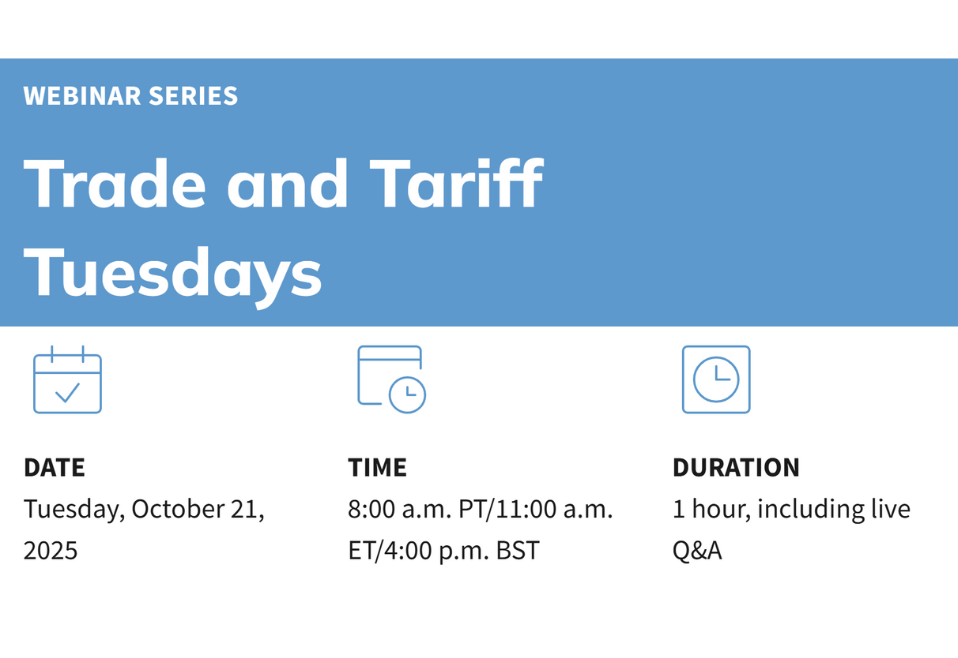

Trade and Tariff Tuesdays – Virtual Event

Join Avalara for smarter moves on tariffs and global compliance Get the latest on global tariff shifts, the future of the de minimis exemption, and how new U.S. and global trade actions could disrupt compliance and costs. Hear from Avalara experts and get strategies to stay ahead. We’ll cover: An...