Upgrade Your Skills Before Year-End: 2025 DSD Sage Year-End Training Now Open

October 7, 2025

As the calendar winds down, many organizations scramble to close out their books, generate 1099s and W-2s, reconcile periods, and comply with tax filings. For Sage users, year-end procedures often come with a unique set of complications:

- Software version compatibility (especially for payroll / tax updates)

- Proper preparation of vendor and employee data

- Timing, sequencing of module closings, and reconciliation

- Avoiding costly corrections or penalties after filings

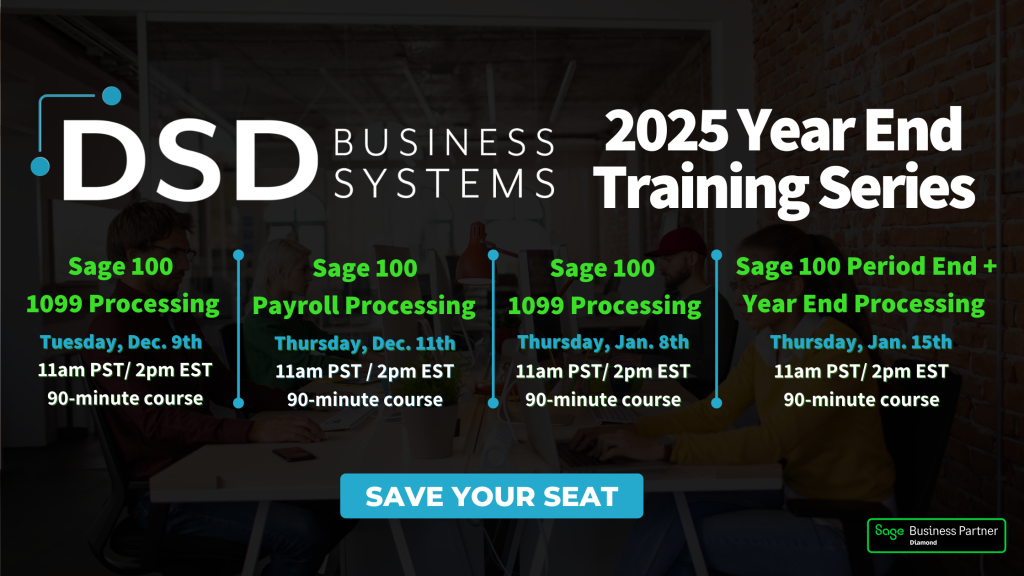

That’s why DSD is proud to bring back the 2025 Sage Year-End Training Series, tailored to help Sage 100, Sage Intacct, and Sage HRMS users execute a smooth, compliant year-end close.

Each class is just $50 when you register by November 30 — our special early-bird pricing designed to help you plan ahead and save. After November 30, the price increases to $75 per course, so registering early ensures you get the best value.

Why join the sage year-end

training series?

Our training series is meticulously crafted to cover essential aspects of year-end processing in Sage 100. Here’s a detailed look at what each course offers:

Sage 100 1099 Processing Course

Tuesday, Dec. 9th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Verify that your version of Sage 100 can process 1099s for 2025

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

Sage 100 Payroll Processing Course

Thursday, Dec. 11th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Year End Processing Requirements

- Tips & Tricks & FAQs

- Year End Checklist

- How to Report Third Party Sick on W2’s

- W-2 Processing

- ACA Processing

Sage 100 1099 Processing Course (Repeat)

Thursday, Jan. 8th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Verify that your version of Sage 100 can process 1099s for 2025

- Changes to 1099 boxes for 2024

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

Sage 100 Period End & Year End Processing Course

Thursday, Jan. 15th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Information to start gathering now

- Module-specific housekeeping steps

- Module processing order & what modules can/should be closed together

- Reconciliations to do prior to Year End Processing

- Critical Sage 100 year-end steps

- Quick Overview of Year End Compliance (1099/information returns)

- Best practices to stay compliant in 2025

Month-end and year-end closing

in sage intacct

Wednesday, Jan. 14th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Best Practice Steps to Close Periods in Sage Intacct *including live demonstrations*

- Tips & Tricks

- Common Issues and How to Resolve

- Attendee Questions

Exclusive Early Bird Pricing

To make this opportunity even more enticing, we are offering an exclusive early bird pricing of just $50 per class if you register by November 30th. After this date, the price will increase to $75 per class. This is a fantastic opportunity to enhance your skills at a discounted rate!

Additional Benefits

On-Demand Access:

All training sessions will be recorded and made available within 24 hours, allowing you to revisit the material at your convenience whenever you need a refresher.

Training Credits:

DSD Service Level Agreement (SLA) clients can redeem annual training credits for these sessions, providing additional value.

Free Sage HRMS Payroll Processing Course:

Since there has been so significant updates this year, we’re offering our past course On-Demand for free! This is an excellent resource for those looking to refresh their knowledge without additional cost.

Stay Updated with timely upgrades

Year-end is always a high-stakes period. One misstep — invalid 1099s, misfiled W-2s, or module reconciliation errors — can cost you time, money, and headaches. The DSD Sage Year-End Training Series is your opportunity to mitigate risk, sharpen your processes, and enter the new fiscal year with confidence.

Don’t wait until the last minute — secure your spot and get prepared early so you can close the year with peace of mind.