COVID-19 Small Business Relief Resources

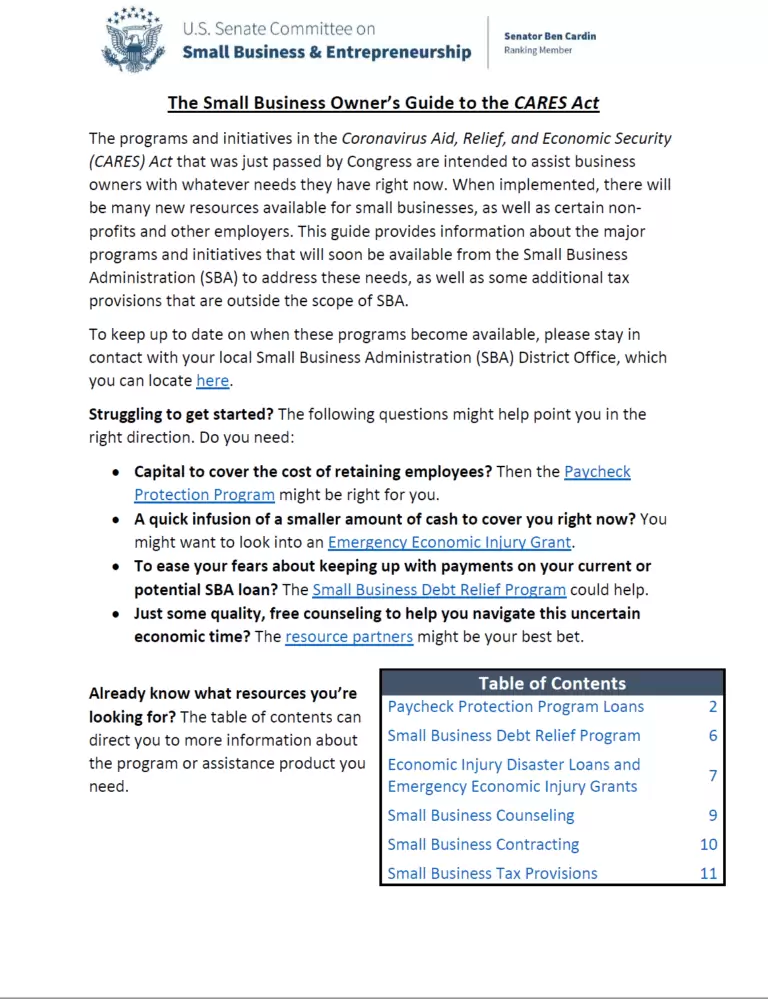

As congress and other government authorities move to save different areas of the economy, it’s important to understand what resources you have available to you as a small business owner. It is the goal of this resource center to provide timely information about the major programs and initiatives available from the Small Business Administration (SBA) to address the immediate needs of small business owners.

Additionally, DSD is committed to offering business advisory services, support services and continuity training to our clients and community at large. We are committed to keeping this list of business resources updated as we navigate through this time together.

CARES Act Info & COVID-19 Resources

Software Channel News & Updates

Webinars, Podcasts & Software Training

Special Offers for Your Business

The Coronavirus Aid, Relief, and Economic Security (CARES) Act recently passed by Congress has allocated $350+ billion to help small businesses keep workers employed amid the pandemic and economic downturn. The CARES Act programs and initiatives are meant to meet the immediate needs of business owners while also honoring the “shelter-in-place” orders to mitigate the spread of the virus.

There are many relief resources available for small business systems, nonprofits and other organisations throughout the nation. See below for some of the latest publications from the US Department of Labor, Small Business Administration, CDC, FEMA and other government agencies offering education and guidance on how to navigate these uncharted waters with reassurance that we will get through this.

CARES Act Loans + COVID-19 Resources

The program provides cash-flow assistance through 100% federally guaranteed loans to employers who maintain their payroll during this emergency.

Small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

Allows small businesses who currently have a business relationship with an SBA Express Lender to access up to $25,000 with less paperwork.

This act provides low-interest Economic Injury loans for up to $2 million, with a $10,000 advance to small businesses or sole proprietors impacted by COVID-19.

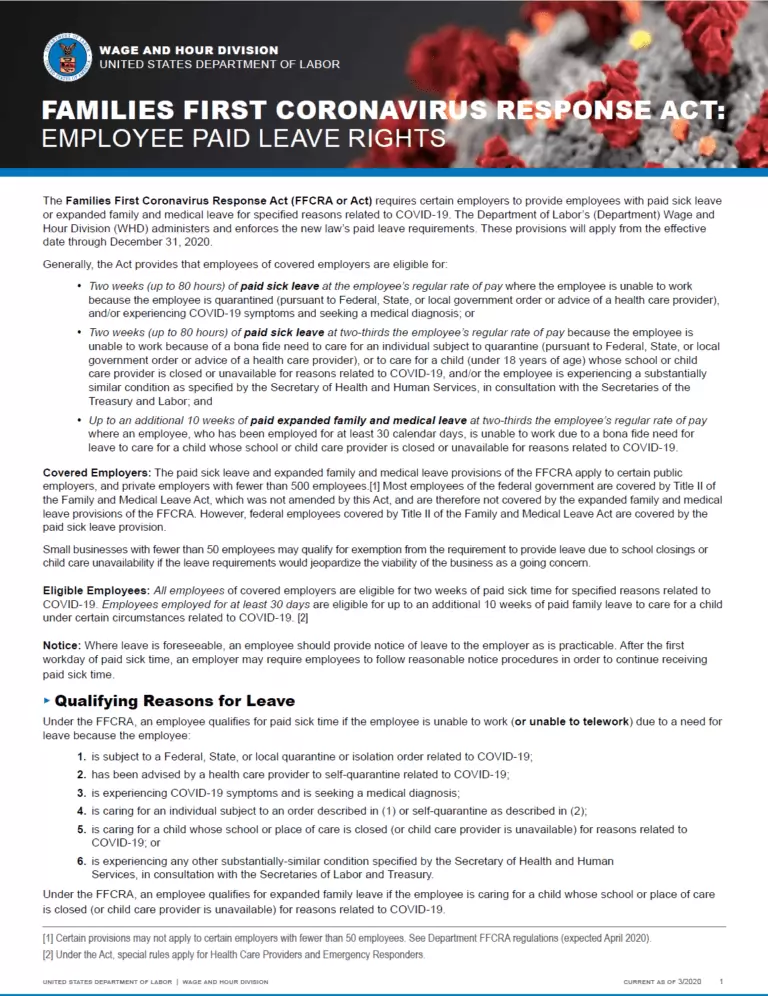

The Families First Coronavirus Response Act (FFCRA) will help American private employers that have >500 employees with tax credits for the cost of providing employees with paid leave.

An employee retention tax credit (Employee Retention Credit) FAQ to encourage Eligible Employers to keep employees on their payroll.

Info on tax credits that reimburse, dollar-for-dollar, the cost of providing paid sick and family leave wages to their employees.

Definitions and frequently asked questions and answers about the FFCRA requirements for employers to provide employees.

The latest from the CDC on Cases in U.S., Testing in the U.S., Public Service Announcements (PSAs) and so much more on America’s progress in the pandemic.

Support & Information for San Diego Businesses and Employers to stay up-to-date on all COVID-19 related issues as they emerge. See Safe Reopening Plan Instructions and Weekly Telebriefing info here.

Better Business Bureau insights to educate and help avoid common scams related to the virus, use precautions when traveling, and find reliable sources to stay informed.

FAQ from the US Dept of Labor if your business has a shortage of workers and is looking to “volunteers” to help out.

Software Channel News & Product Updates

As a Microsoft partner, DSD can get you a FREE 6-month trial of Microsoft Teams, a very capable remote office tool that includes full meetings, collaboration and workflow capabilities.

Sage Intacct has collated several tips and other advice to help you adapt and continue to drive your business forward during the COVID-19 outbreak.

Sage’s response and resources to help navigate the current Coronavirus situation and get support for Sage your solutions through cloud connected apps.

How current Acumatica businesses are operating in this new economic landscape and running smoothly with secure, mobile access to their cloud ERP solution.

Avalara’s compilation of tax news related to the COVID-19 outbreak at the state, federal and global levels. It will be updated regularly as more information becomes available.

Set up to pay employees Emergency Paid Sick Leave and Emergency Family Medical Leave associated with the HR_6201 – Families First Coronavirus Response Act (FFCRA) in Sage 100.

Set up earnings codes and tax codes associated with the HR_6201 – Families First Coronavirus Response Act (FFCRA) in Sage HRMS.

Set up earnings codes and tax codes associated with the HR_6201 Families First Coronavirus Response Act (FFCRA) in Sage Abra Suite. |

Criterion HCM will be providing time off plans to all US-based customers. These plans will be placed in the system as inactive, with an attached income and time off type code(s), that require activation.

Top 10 questions and answers regarding how the Coronavirus Aid, Relief, and Economic Security (CARES) Act affects your business running Sage Software.

Sage Support offers assistance and guidance on the specific reports the Payment Protection Plan loan application requires. Contact DSD for assistance.

Sage Intacct covers steps you can take to help leverage the Act for your specific situation and how to address your most serious financial challenges during the COVID-19 crisis.

Webinars, Podcasts, and Training

To help your business through these trying times, Sage is offering FREE access to select eLearning packages, certifications, and webinars through May 31, 2020.

A series of FREE 1-hour learning sessions (live and on-demand) to help you learn how to get the most out of your Sage 100cloud solution.

A series of FREE one-hour webinars designed to help HRMS customers become more proficient with their software features, hosted by Sage HRMS.

Understand what needs to be set up in Sage Abra Suite and Sage HRMS. In Sage HRMS, Sage creates COVID-19 local tax codes and earning codes for Emergency paid FMLA and sick leave.

Five resources to help businesses facing financial difficulties navigate the current times.

Advice from Sage Colleague – Rafael Casas on some of the COVID-19 resources available from Sage and other channel Partners.

Support & Information for San Diego Businesses and Employers to stay up-to-date on all COVID-19 related issues as they emerge. See Safe Reopening Plan Instructions and Weekly Telebriefing info here.

Field-tested tips to how you and your employees can work from home more easily.

Experts from software and technology companies offer four tips for forecasting billings, cash, and revenue during COVID-19 uncertainty.

Hubspot’s overview of the largest economic stimulus package in history available to small businesses and individuals impacted by the COVID-19 pandemic.

Join your finance peers for this complimentary virtual event focusing on managing cash, expenses, and expectations at your companies during these uncertain times.

Hear from Fortune CEO Alan Murray as he interviews the top CEOs for insights into what they’re doing, why they are doing it, and what impact it is having.

Here are some helpful tips to improve your next video meeting.

The COVID-19 pandemic has showcased the value of IT and digital transformation.

Learn how DocLink helps digitally manage documents and data, and automate processes in any situation.

These tips will help you and your team be productive regardless of where they work.

Special Offers for Your Business

Sage 100 users are finding the need to view, access, and store documents in new ways – and InstaDocs wants to help! Increase remote productivity with 50% off InstaDocs!

On Scanco’s best-in-class warehouse and manufacturing automation tools, get 90 days of zero payments without interest for 12 months.

Start your 14-day free trial with advanced Acumatica analytics by DataSelf. Get better insights to your data now!

Tax help when you need it most. Simplify sales tax compliance with automation and focus on the real priorities in your business.

Remote access to AP processes you can count on. Sign up by May 30th, 2020 to take advantage of our Remote AP and Payments Business Continuity offer with no expense for the first 12 months.

For a limited time, you can get a Sage 100-integrated employee and customer online portal with no upfront fees, reduced monthly fees, and no long-term commitment.