Sage 100 Payroll – How to Process Non-Cash Fringe Benefits

January 4, 2021

by Kimberly Tucker, Director, Marketing

Why Use Non-Cash Fringe Benefits?

Non-cash fringe benefits should be included in the last payroll of the year because they require withholding of payroll taxes.

The Payroll module can perform the necessary tax calculations and provide reporting for processing taxable, non-cash fringe benefits. When the Payroll module is properly set up, taxes are deducted automatically for all fringe benefits reported, and the net pay amount is adjusted. The fringe benefit amounts are properly recorded and reported on employee W-2 Forms. Multiple earnings codes can be set up as fringe benefits, and an automatic deduction will be established for the gross amount of the fringe benefits.

Defining Fringe Benefit Earnings and Deduction Codes

Earnings codes that are used to record fringe benefits must first be established in Earnings Code Maintenance with the fringe earnings type. The fringe earnings type is used to specify non-cash fringe benefits (for example, life insurance or use of company automobile).

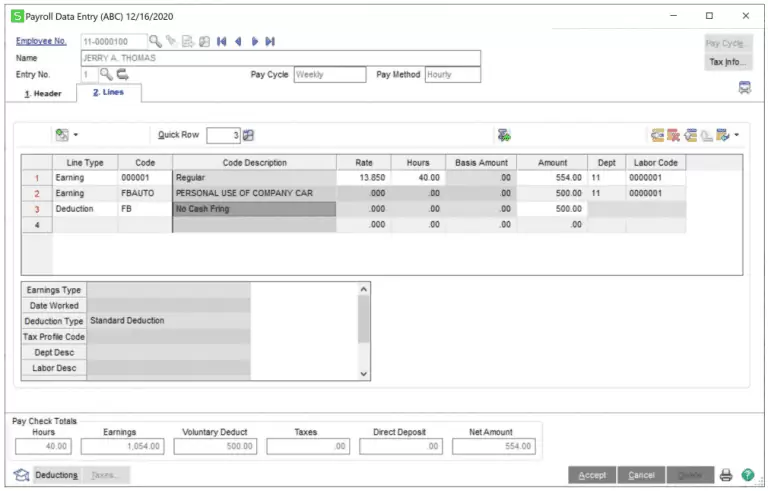

When an earnings code with the fringe earnings type is entered in Payroll Data Entry, an offsetting line with deduction code FB is created automatically to deduct the Fringe Earnings line amount from the net check amount. Deduction code FB is a permanent record and cannot be deleted. The fringe benefit earnings are added to the gross wages. The fringe benefit information is included in the gross amount and is printed in the box labeled Benefits included in Box 1 on your W-2 Forms.

Fringe Benefits and Employee Maintenance

The Fringe Benefit field on the Benefits tab in Employee Maintenance is used to display year-to-date fringe benefit amounts (all earnings entered with the fringe earnings type) received by the current employee and reported as taxable income.

The field on the Benefits tab can only be viewed. If you need to manually enter the year-to-date amount, click the arrow in the top-right corner of the window and select Tax Summary. On the Employee Tax Summary window, click Benefits. You can then edit the Fringe Benefits field in the Benefits window.

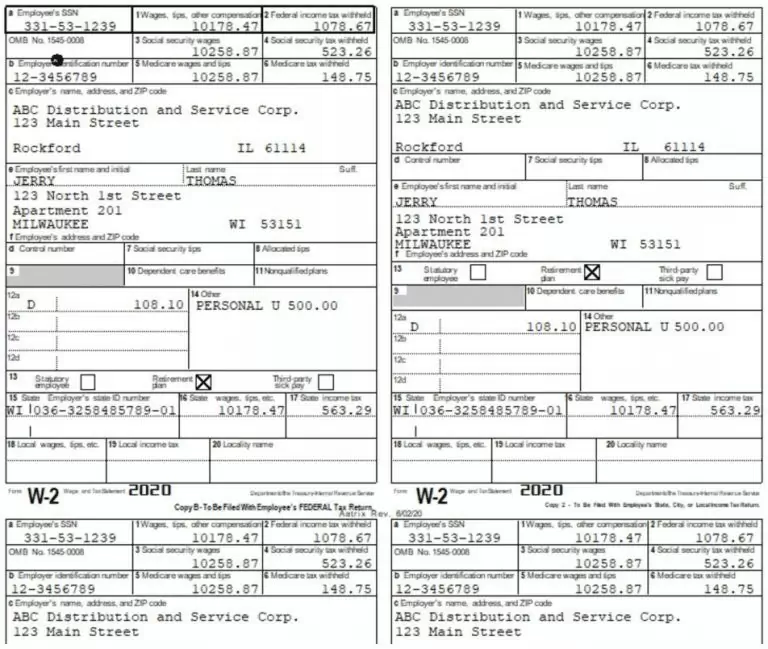

W2 Forms

Fringe Benefit information is included in the gross amount (Box 1) and if applicable, in boxes 3, 5, 16, and 18.

Example of Fringe Benefit Deduction Codes

Assume that earnings code MI (Mileage) was created with the fringe earnings type. If you use earnings code MI in Payroll Data Entry to record employee mileage for personal use of a company car, you do not want to include this cents-per-mile amount in the net check amount. In Payroll Data Entry, the entire amount of earnings code MI has an offsetting line with deduction code FB created automatically. This prevents the mileage line amount from being included in the net check amount.

The benefits of using this method of reporting fringe benefit allowances are that the fringe amounts are reported as gross earnings; the proper taxes are deducted from the regular pay; and the fringe deductions are printed in the box labeled Benefits included in Box 1 on your W-2 Forms.

See the complete illustration below.

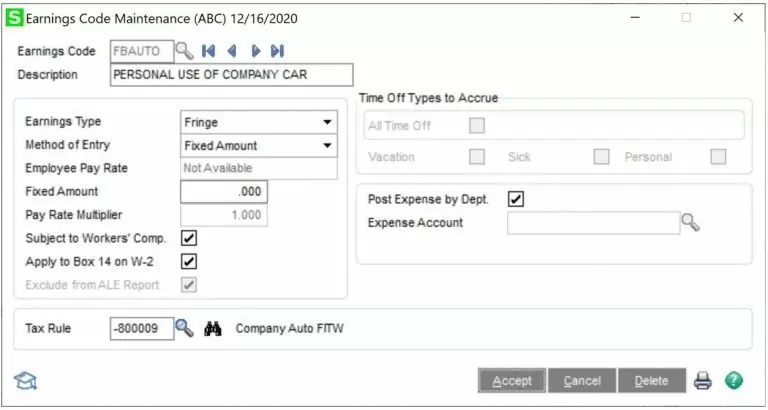

Create a type "FBAUTO" earnings code with proper Earnings Type and Tax Rule.

Earnings Type

Select the appropriate earnings type for this earnings code.

- Select Fringe to specify non-cash fringe benefits. When an earnings code with a fringe earnings type is entered in Payroll Data Entry, an offsetting line with an FB deduction code is created automatically to deduct the line amount from the net check amount. The fringe benefit information displays in the box labeled “Benefits included in Box 1” of your W-2 Forms.

NOTE: The earnings type cannot be changed for any of the preexisting earnings codes or for any earnings code that has been used to process payroll if the associated history is still on file.

Apply to Box 14 on W-2

Select this check box to include year-to-date earnings for this earnings code in box 14 on W-2 forms.

Tax Rule

Enter a tax rule to determine which taxes the selected earnings code is subject to. Click the Lookup button to view the list of tax rules, which are maintained in the tax calculation engine. Please note that there are two tax rules for personal use of company car. Check with your tax advisor to determine which one to use.

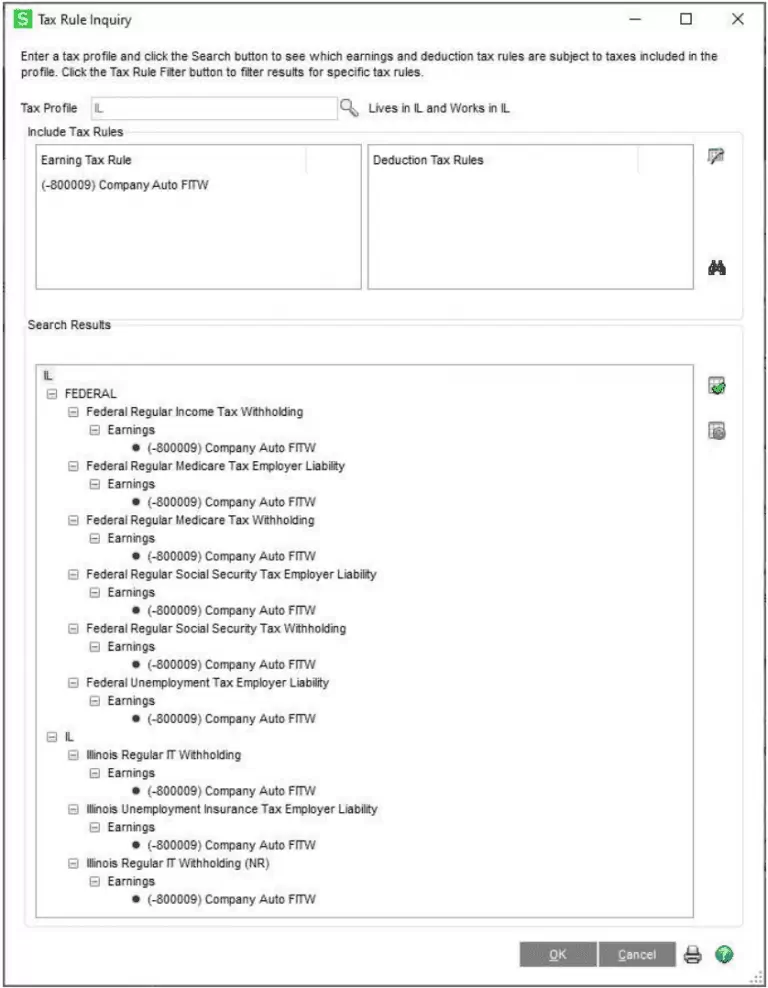

The -800009 tax rule: Earnings amount is subject to Federal Income Tax (and withholding), Medicare Tax (employer and employee), FICA Tax (employer and employee), Federal Unemployment Tax, as well as State of Illinois Income tax (and withholding), and State of Illinois Unemployment tax. You can tell this by clicking the binoculars button.

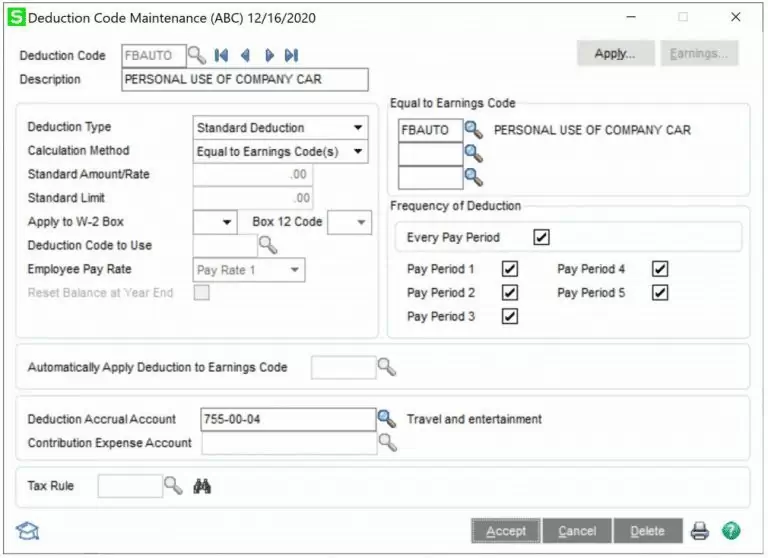

Create a type "FBAUTO" deduction code with the proper Calculation Method

Calculation Method

Select Equal to Earnings Code(s) to calculate a deduction amount equal to the earnings amount for up to three specified earnings codes. This method should be used only if you do not want to include certain earnings amounts on the paycheck. If you select this method, enter up to three earnings codes in the Equal to Earnings Code fields.

Equal to Earnings Code

Enter up to three earnings codes for this deduction code, or click the Lookup button to list all earnings codes. These fields are available only if Equal to Earnings Code(s) is selected in the Calculation Method field.

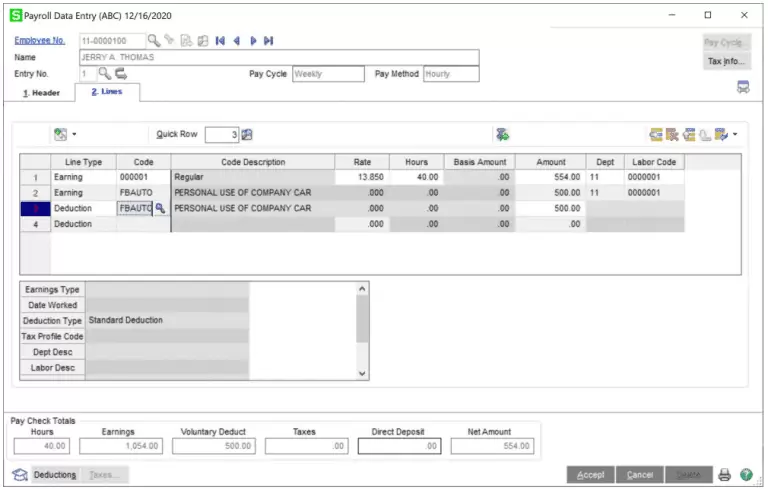

When the FBAUTO earnings code is entered in Payroll Data Entry, an offsetting line with deduction code FBAUTO is created automatically to deduct the Fringe Earnings line amount from the net check amount.

Change the FB deduction code to the FBAUTO deduction code.

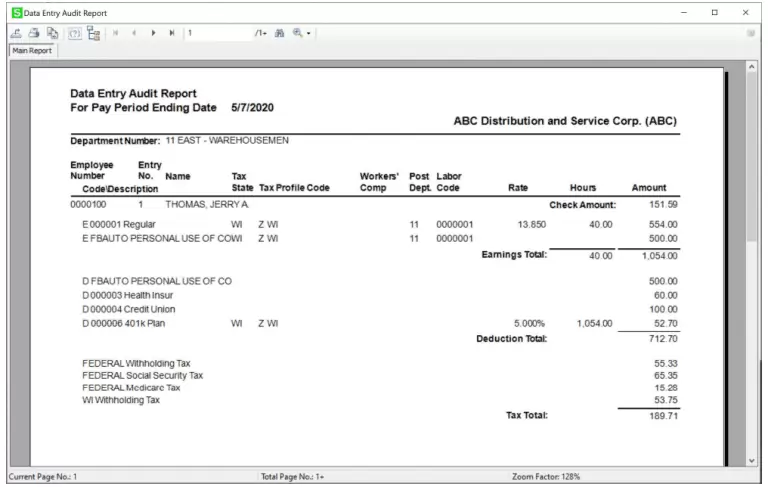

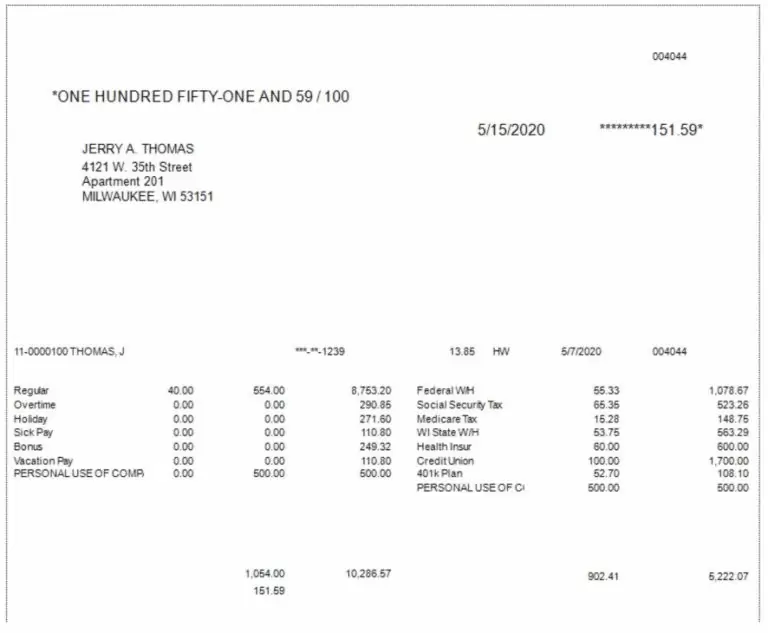

Sample of PR check

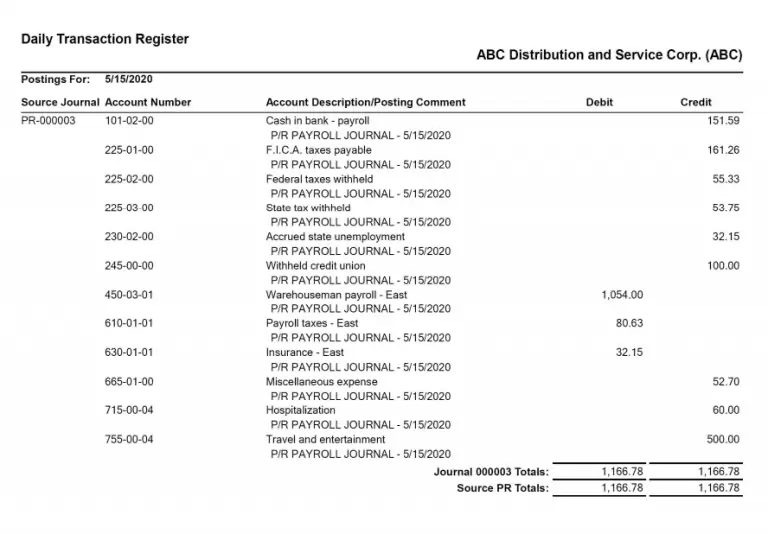

Sample of GL Posting (non-cash fringe expensed to Wages as debit and credited to Travel and Entertainment Expense which is what we set up in the FBAUTO earnings code and the FBAUTO deduction code).

Sample of W2 Form (notice the Personal Use of Company Auto is in Box 14 because we checked that box in Earnings Code Maintenance for the FBAUTO earnings code).